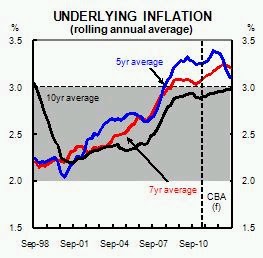

What? Underlying inflation problems in Australia? Are you kidding? Don't be silly. Who cares anyway? Not the guys on main street! They all want lower interest rates. Cut rates and you will be a hero man. Nobody could give a rats about the RBA's so-called "mandate". And I don't remember seeing any 2-3% target in the 1959 Act, by the way. If they don't know what your target is, how can your credibility possibly be affected if you keep on missing it? That's a free-pass buddy. Who needs a target, anywho? Some boffins just dreamt this thing up in the early 1990s. Why not have a much higher, say 4%, target like the Chinese, or maybe even a moving target? Why give our commercial competitors an inflation advantage!? And ignore the 5, 7 or 10 year rolling annual underlying inflation averages. There were a lot of "one-offs", after all, during the last decade. Let me spell it out for you: "G" "F" "C". And haven't you heard, the ABS's measure of the CPI is upwardly biased...

Real-time, stream-of-consciousness insights on financial markets, economics, policy, housing, politics, and anything else that captures my interest. Tweet @cjoye

The author has been described by News Ltd as an "iconoclast", "Svengali", a pollie's "economist muse", and "pungently accurate". Fairfax says he is a "Renaissance man" and "one of Australia’s most respected analysts." Stephen Koukoulas concludes that he is "85% right", and "would make a great Opposition leader." Terry McCrann claims the author thinks "‘nuance’ is a trendy village in the south of France", but can be "scintillating" when he thinks "clearly". The ACTU reckons he’s "an enigma wrapped in a Bloomberg terminal, wrapped in some apparently well-honed abs."