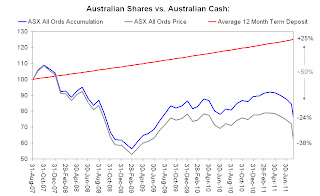

I am pretty confident that since 2008 I have been Australia's biggest equities "bear" vis-a-vis cash and fixed-income, and the most relentless critic of sub-optimal asset-allocation decisions by super funds and retail investors, which our analysis has consistently shown to be massively overweight listed (Aussie and global) equities relative to cash and fixed-income. See, for example, these two January 2009 articles published with Business Spectator here and here, this October 2009 article, or my 2011 missives here and here. And this is how the two asset-classes have performed over the last four years...

Real-time, stream-of-consciousness insights on financial markets, economics, policy, housing, politics, and anything else that captures my interest. Tweet @cjoye

The author has been described by News Ltd as an "iconoclast", "Svengali", a pollie's "economist muse", and "pungently accurate". Fairfax says he is a "Renaissance man" and "one of Australia’s most respected analysts." Stephen Koukoulas concludes that he is "85% right", and "would make a great Opposition leader." Terry McCrann claims the author thinks "‘nuance’ is a trendy village in the south of France", but can be "scintillating" when he thinks "clearly". The ACTU reckons he’s "an enigma wrapped in a Bloomberg terminal, wrapped in some apparently well-honed abs."