Okay, the latest batch of economic data today would not be exactly giving the inflation-watching Mandarins the heebie-jeebies. Before I go on, a word about my view in case there is any doubt (I have no idea whether the RBA shares it).

In short, the most important economic indicators for the RBA are inflation and unemployment. The inflation data has spoken, and the RBA should have hiked in May, or June at the latest. There is no reason to delay. All standard Taylor Rules tell us they should be popping off at least another two hikes this year. For the time being, another 25bps ain't gonna change the price of eggs in China. And remember: it is a helluva lot easier to bring a car travelling at 80km/hr back to the 60km/hr speed limit than trying to do so from 120km/hr (eg, at the end of this year, as Goldman Sachs would argue is appropriate).

Turning back to today's numbers, average weekly wages grew at 1.0% in the first quarter of 2011 (so around 4% annualised), which was less than the expected 1.2% growth. Averaging the last six months of data gives a 1.25% growth rate. I would classify this as broadly consistent with the more accurately measured (stratified) wages data yesterday, which suprised on the downside with a 0.8% print (vs. expectations of 1.1%). Including bonuses, yesterday's wages data also grew at a 1% rate for the quarter. For mine, I always thought it was hard to see big wage increases in Q1 with all of the natural disasters. In contrast, Q2 looks like a more obvious candidate for rising labour costs. So surprises on this front would be more view-changing.

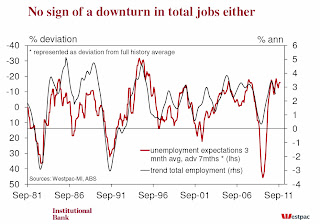

The other encouraging news for the RBA is that consumer inflation expectations have continued to taper in May, falling to 3.3%, which, while still above average, is heading in the right direction. On the other hand, consumer expectations about employment are very strong, and lend more weight to the low unemployment rate than the volatile jobs numbers.

I have enclosed below Westpac's summary and some very cool charts on consumer unemployment and inflation expectations:

"Median inflation expectations eased a touch to 3.3% in May from 3.5% in April and are well down from the recent peak of 4.6% in January. This is the lowest reading since December 2010 (2.8%) but it still (just) above the average since 1994 (3.2% since the start of inflation targeting by the RBA). The median for professionals rose to 3.9% from 3.5% in April but nevertheless still reveals a moderating trend from since January. May was a bit more of a mixed read on inflation expectations but they remain consistent with two key themes. The first is that impact of the natural disasters on fresh fruit and vegetables, and the spike in petrol prices, appear to have had a transitory impact on inflationary expectations. As hoped, they don't appear to impacting on longer-run expectations. The second is that the level of inflationary expectations remain elevated compared to the long-run average suggesting that consumers, and even more so professionals and managers, are expecting overall inflation to be somewhat higher than what they are used to.

On the jobs front, households’ expectations for unemployment fell 3% in May to now be 5.1% lower than a year ago. Remembering that falling unemployment expectations is an indicator of consumers’ perception of a firmer jobs market, it does appear to be more consistent with the fall in the unemployment rate than the recent volatility in the monthly employment numbers. It should also be noted that the recent movements in unemployment expectations have been very small in a historical sense and as such, the overall level of expectations remain very low and consistent with strength in full–time jobs growth. While clearly not pointing to an acceleration in jobs growth from here, consumers are still telling us that they are still experiencing a quite robust labour market."

Real-time, stream-of-consciousness insights on financial markets, economics, policy, housing, politics, and anything else that captures my interest. Tweet @cjoye

The author has been described by News Ltd as an "iconoclast", "Svengali", a pollie's "economist muse", and "pungently accurate". Fairfax says he is a "Renaissance man" and "one of Australia’s most respected analysts." Stephen Koukoulas concludes that he is "85% right", and "would make a great Opposition leader." Terry McCrann claims the author thinks "‘nuance’ is a trendy village in the south of France", but can be "scintillating" when he thinks "clearly". The ACTU reckons he’s "an enigma wrapped in a Bloomberg terminal, wrapped in some apparently well-honed abs."