RBS's Kieran Davies and Felicity Emmett are two of Australia's best technical economists, and their "weekly" is a must-read. In the latest publication KD and FE touched on the volatility arguments I outlined in my most recent Business Spectator piece (see here). They make several other interesting points too:

(a) market economists have consistently underestimated the rate of economic growth in China;

(b) the boom in business investment in Australia is going to significantly expand the economy's productive capacity, which suggests that Australia's maximum 'potential growth rate' will increase from around 3.25 per cent today to closer to 4 per cent in the future; and

(c) this, critically, implies that the RBA’s 'neutral cash rate' will be higher than it has been in the past, and likely around 5.5 per cent even accounting for the material widening in the cash rate-to-lending rate margin. This contrasts with the current consensus that neutral is around 4.5 per cent.

Enclosed below are some choice quotes/charts:

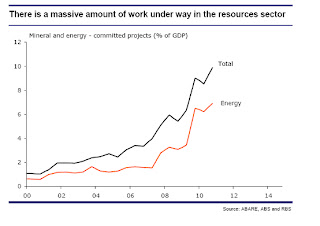

"Construction work done is already close to the record 7% of GDP reached during the first stage of the resources boom and will easily surpass it given the massive pipeline of projects already commenced. This pipeline is already a huge 8% of GDP, or 13% of GDP if you add in the coal seam gas projects in Queensland…

[T]he strength is concentrated in engineering construction, where work on mining projects dominates. For example, using the Bureau of Agricultural and Resource Economics project listings, the pipeline of “committed” minerals and energy projects stands at a record 10% of GDP…

More remarkably, this pipeline of committed projects is small relative to the pipeline of “less advanced” projects under consideration. Again relying on the Bureau of Agricultural and Resource Economics project listings, the pipeline of “less advanced” projects has doubled to about 20% of GDP (these are mostly in the energy sector). The pipeline is off its recent all-time high, but this is because projects are joining the “committed” category of projects rather than being cancelled.

While the bright outlook for investment should underpin fast growth over the next few years, the sheer size of the investment pipeline means that growth could also be more volatile…

The investment pipeline also represents a massive increase in Australia’s capacity. Even though population growth may have peaked, it is still solid and the strong growth in the capital stock means that our potential growth rate is more likely to be 4% rather than the 3% analysts traditionally use.

This has implications for the Reserve Bank in managing the resources boom in that a higher potential growth rate means that the neutral real cash rate should be higher than the 3% the Bank has historically used.

This suggests that while wider bank margins between lending rates and the cash rate work to lower the neutral short rate, a faster potential growth rate works in the other direction and perhaps the two balance each other out. If this is the case, then a neutral nominal cash rate is still probably around 5½%.

Longer term, the strength in investment hinges on the outlook for non-Japan Asia, particularly China. While the market has persistently underestimated Chinese growth, the business cycle is not dead and it is possible that at some point over the next 5 years that China slows sharply, in which case the investment boom would be an early casualty of such a downturn."

Real-time, stream-of-consciousness insights on financial markets, economics, policy, housing, politics, and anything else that captures my interest. Tweet @cjoye

The author has been described by News Ltd as an "iconoclast", "Svengali", a pollie's "economist muse", and "pungently accurate". Fairfax says he is a "Renaissance man" and "one of Australia’s most respected analysts." Stephen Koukoulas concludes that he is "85% right", and "would make a great Opposition leader." Terry McCrann claims the author thinks "‘nuance’ is a trendy village in the south of France", but can be "scintillating" when he thinks "clearly". The ACTU reckons he’s "an enigma wrapped in a Bloomberg terminal, wrapped in some apparently well-honed abs."