In recent months there has been frequent speculation—often from foreign investors—that Australian house prices are significantly overvalued and that the bursting of this bubble will threaten the balance-sheets of Australia’s banks.

In this context, US investment legend, Jeremy Grantham, captured global media attention with the claim that Australia’s housing market was a “time bomb” on the basis of his view that Australian house prices were “7.5 times family incomes”, which he alleged was around twice what they should be.

Scores of hedge funds from around the world are actively shorting the shares of Australia’s banks—that is, betting that they will decline in value—on the basis of these opinions. In the industry lexicon, this is an “overcrowded trade” and arguably poses a threat to the stability of Australia’s financial system.

Rismark itself has been directly contacted by many of these hedge funds asking for our advice on the state of Australia’s $3.5 trillion housing market, which accounts for about 60 per cent of household wealth and roughly the same share of bank assets.

Utilising the latest ABS National Accounts data combined with Australia’s most comprehensive residential sales database, which captures 100 per cent of all home sales executed across the country, Rismark finds that Australia’s home price-to-disposable income ratio is only 4.6 times as at June 2010 (ie, nearly 40 per cent less than Mr Grantham’s claim).

This price-to-income ratio is unchanged from Rismark’s previous estimate of 4.6 times in the March quarter and, crucially, is almost exactly in line with the seven year average since the end of the last housing cycle in December 2003. On this basis, there would appear to be no evidence that Australia’s housing market valuation has become more stretched in recent times, as is commonly believed.

Some investors have tied together the empirically flawed arguments above with the claim that Australia’s banks are particularly vulnerable due to their heavy reliance on wholesale funding and high loan-to-deposits ratios. This, however, appears to ignore the fact that the Commonwealth has demonstrated that it will vouchsafe the liquidity of the banking system in the event that it is ever mortally threatened by guaranteeing its funding sources.

During this GFC, the Commonwealth guaranteed both bank deposits and the banks’ wholesale funding liabilities, thereby affording institutions the protection of the Commonwealth’s very strong AAA-rating. The Commonwealth did this because a viable banking system is a condition precedent to a functioning economy—banks are, after all, the conduits that link national savings with investment.

If hedge funds want to construct a credible critique of Australian bank funding lines, they must in effect create a defensible case for a sovereign debt crisis. Given Australia’s extraordinarily low net debt-to-GDP ratio, this is an extremely arduous task.

Unlike other estimates, Rismark’s national home price-to-disposable income ratio includes dwellings in all regions (ie, not just capital cities), all property types (ie, not just detached houses), and the ABS’s quarterly measure of average disposable household incomes (ie, not just average weekly earnings), which captures income earned from all areas (eg, labour and investment income) and reflects the fact that there is typically more than one income earner per household.

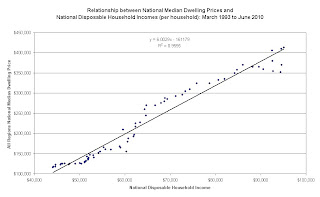

Rismark finds that over the last 17 years there has been a remarkably strong and stable relationship between Australian home prices and disposable household incomes (on a per household basis). The first chart below illustrates this relationship.

The observations in the top right hand corner of the chart, and to the right of the trend line, represent the period during the GFC when Australian dwelling prices fell modestly while household incomes remained high due to the fiscal stimulus, amongst other things. This resulted in a sharp but temporary fall in the home price-to-income ratio.

There has only been a relatively brief period during which Australian dwelling prices have outpaced disposable incomes between 2000 and 2003, which, Rismark believes, was an artifact of the impact of the secular decline in nominal mortgage rates following the RBA formally shifting to an inflation-targeting regime in 1996. To highlight this point, the next chart depicts the change in Australia’s headline variable mortgage rate since 1980.

Between 1980 and 1996 the average variable mortgage rate was 12.6 per cent. Since 1996 the average rate has been just 7.3 per cent, which is almost exactly where rates remain today. Observe how the ‘level’ of mortgage rates did not stabilise until the early 2000s. It was presumably at this point that home buyers had more confidence that the future path of inflation and interest rates would remain stable around the 6-8 per cent level.

In the final chart we illustrate the change in Australia’s national dwelling price-to-disposable income ratio since 1993. For completeness, this ratio compares both average and median dwelling prices across all metro and non-metro regions (and, critically, all property types) with average Australian disposable household incomes as calculated by the ABS.

Rismark estimates that the national median dwelling price based on sales in all regions throughout Australia, and encompassing all detached houses, semis, terraces and units, was $413,000 as at June 2010. The trimmed mean* dwelling price, which is analogous to the ‘average’ as opposed to ‘median’ home value, was a little higher at $441,848.

Rismark’s analysis draws on Australia’s largest residential sales database, which is supplied by RP Data (ASX: RPX) and captures 100 per cent of all homes sales transacted across the country. In total, RP Data has more than 150 million real estate records and spends over $9 million each year collecting new data.

HIA data shows that there are currently 8.57 million households in Australia, which, given the latest ABS National Accounts figures, means that average disposable income is $95,089 per household.

It is important to note that this income estimate is the ABS National Accounts measure as at June 2010 divided by the total number of households. It represents the total disposable wage and investment income generated by all members of the household and should not be confused with simpler estimates of average wages or median incomes.

In closing, the Deputy Governor of the RBA, Ric Battellino, recently offered further weight to this analysis. In particular, he remarked:

"People feel that house prices in Australia are quite high, and that’s quite often because the ratio of house prices to income that are published for Australia tend to focus mainly on prices in the cities, and they are quite elevated. But, if you look across the whole country, the ratio of house prices to income is not that different from most other countries...the house prices in cities aren’t high relative to the income in the cities because most of the figures you see published on house prices to income – what they do is they measure house prices in the city and express it as a proportion of income of the whole country. But, if you do house prices relative to the incomes of the people living in those areas, then the prices in the cities also are quite reasonable."

*The ‘trimmed mean’ is similar to the measure used by the RBA when estimating inflation. A simple average results in volatile estimates due to occasional valuer general data entry errors. The trimming process results in the truncation of only the top and bottom 5 per cent of prices within the price distribution.

Real-time, stream-of-consciousness insights on financial markets, economics, policy, housing, politics, and anything else that captures my interest. Tweet @cjoye

The author has been described by News Ltd as an "iconoclast", "Svengali", a pollie's "economist muse", and "pungently accurate". Fairfax says he is a "Renaissance man" and "one of Australia’s most respected analysts." Stephen Koukoulas concludes that he is "85% right", and "would make a great Opposition leader." Terry McCrann claims the author thinks "‘nuance’ is a trendy village in the south of France", but can be "scintillating" when he thinks "clearly". The ACTU reckons he’s "an enigma wrapped in a Bloomberg terminal, wrapped in some apparently well-honed abs."