The Governor is giving a speech today on Monetary Policy and the Regions. This will be followed by the Minutes from the September Board meeting tomorrow. Both have the potential to impart material new information about the RBA's latest thinking on the economy and rates.

What might the Governor say today? While I expect his overall tone to be moderately hawkish (ie, rates are not heading down in subtle-Governor-speak), I suspect he will be more dovish than his colleague, Dr Phil Lowe, was last week.

The speech will probably be about the effect of monetary policy on regions that may not be growing as rapidly as those areas exposed to the resources sector, which would be the real focus of any RBA tightening.

I am guessing this speech is, therefore, aimed at explaining what monetary policy is all about, how it is a very blunt instrument with long lags (ie, up to two years), how it is the only tool the RBA has in its arsenal aside from jaw-boning and moral suasion, and how slower growth regions can best adapt to situations where they are effectively the collateral damage in a tightening cycle.

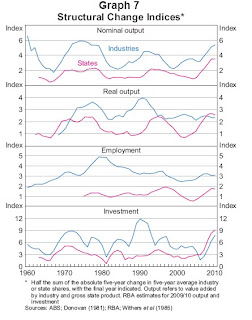

This should, therefore, build on the fascinating 'structural change' analysis the RBA published last week in its Bulletin series. This work shows that Australia is experiencing the highest rate of inter-state economic change seen since the analysis began in 1960 (refer to the pink lines in the chart below).

The speech will, as a result, likely be a bit of a PR exercise laying the groundwork for the nontrivial risk that the RBA has to lift rates substantially if resources boom Mk II takes off. It will thus represent an extension of what appears to have been a concerted campaign by the RBA to mobilise our thinking about what Australia's otherwise very promising future might look like, and how we might best prepare for it.

Last week we heard from Phil Lowe that this future is much more closely tied to China and India (not the 'anglosphere' as the media believes), will be propelled forward by an enormous increase in capital investment, and will probably be subject to higher economic uncertainty given the intrinsic volatility of these two industrialising countries. In this context, analysis published by CBA on Friday showed that Australia is today closer to the world’s economic ‘centre of gravity’ than at any previous point in our history (see below).

Crucially, Dr Lowe reiterated a common theme in recent RBA rhetoric: Australian households, which are typically the single biggest source of economic activity, are going to have to roll-over and make room for the resources boom. Here the RBA is bending over backwards to encourage households to be conservative: save more and leverage less are their key mantras. The implicit threat is that if households revert to their old spending habits rates will be forced higher than would otherwise be the case.

One critical quote in this context was Lowe’s comment that the economy is already operating at close to ‘full employment’. That means we are starting off the recovery with capacity constraints in the labour market. The RBA is effectively giving politicians two choices: you can foster productivity, labour market flexibility, and skilled migration to ameliorate labour shortages via ‘supply-side’ reform, or we will deal with it ourselves by crushing labour demand using interest rates.

Another motivating driver for this speech will be the fact that the RBA is understandably very sensitive to public perceptions of its policy conduct, and its role in the community more broadly. They know that both their formal independence, and their reputation for maintaining price stability, are only relatively recent innovations in the scheme of things. And they know that many central banks overseas are losing a grip on both.

In recognition of this, this RBA has taken unprecedented steps to lift its transparency and the frequency of its communications, which is a tribute to Glenn Stevens. Under Stevens' tenure, we have seen the advent of very detailed minutes and a much higher tempo of speeches by senior staff. We have also had the Governor himself being interviewed by a mass media television station, which was a contemporary first.

I very much doubt whether the Governor appreciated being vilified on the front page of a tabloid during the final phases of the last tightening cycle. So this is all about developing a more constructive conversation with the people, being upfront about the challenges, and giving them every chance to think about how they might adapt to Australia’s different prospects.

As a final thought, the Governor will not want to be seen to pre-judge the RBA’s Board meeting next week, especially given the vigorous debate that took place around the RBA’s governance systems late last year.

To the extent the speech is more hawkish than I anticipate, it will afford very telling insights indeed into the RBA’s thinking.

Real-time, stream-of-consciousness insights on financial markets, economics, policy, housing, politics, and anything else that captures my interest. Tweet @cjoye

The author has been described by News Ltd as an "iconoclast", "Svengali", a pollie's "economist muse", and "pungently accurate". Fairfax says he is a "Renaissance man" and "one of Australia’s most respected analysts." Stephen Koukoulas concludes that he is "85% right", and "would make a great Opposition leader." Terry McCrann claims the author thinks "‘nuance’ is a trendy village in the south of France", but can be "scintillating" when he thinks "clearly". The ACTU reckons he’s "an enigma wrapped in a Bloomberg terminal, wrapped in some apparently well-honed abs."