A friend of mine (who is a top interest rate strategist) recently brought to my attention the Treasury’s latest interest rate assumptions. Getting these numbers right is crucial for a range of reasons including quantifying the cost of Australian government debt when undertaking new nation-building projects.

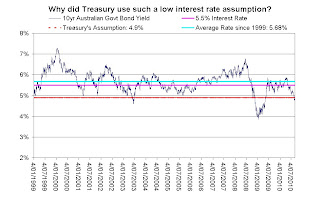

This time around the Treasury has assumed an unusually low long-term interest rate of just 4.9% at a time when government debt levels have risen rapidly. My strategist colleague noted that over the last decade or so the average interest rate paid by taxpayers when issuing 10 year government bonds has actually been about 5.7%. He also opined that such a low interest rate assumption was inconsistent with the Treasury’s very optimistic forecasts for long-term growth.

In recent months 10 year rates plummeted on the back of the European sovereign debt crisis and concerns about a double-dip recession in the US. Yet given Australia’s surprisingly robust economic growth (ie, an above-trend +1.2% in the second quarter) combined with a raft of more positive Chinese, European and US data, it is somewhat unlikely that long-term rates will remain as low as they currently are.

With all of this in mind, assuming that the interest rate the government pays on its long-term debt is, say, 5.5%--which is almost exactly in line with the rates paid over the last decade--looks to be no less credible (and possibly more reasonable) than Treasury’s estimate.

Real-time, stream-of-consciousness insights on financial markets, economics, policy, housing, politics, and anything else that captures my interest. Tweet @cjoye

The author has been described by News Ltd as an "iconoclast", "Svengali", a pollie's "economist muse", and "pungently accurate". Fairfax says he is a "Renaissance man" and "one of Australia’s most respected analysts." Stephen Koukoulas concludes that he is "85% right", and "would make a great Opposition leader." Terry McCrann claims the author thinks "‘nuance’ is a trendy village in the south of France", but can be "scintillating" when he thinks "clearly". The ACTU reckons he’s "an enigma wrapped in a Bloomberg terminal, wrapped in some apparently well-honed abs."