There is mounting, albeit unconfirmed, speculation that a derivative of the “People’s Bank” idea that I and five other economists canvassed last year is going to get off the ground as part of the Gillard Government’s 2010 election campaign.

Following our proposal that the government consider the role that Aussie Post could play in supplying commodity financial services, and helping level the otherwise (un)competitive playing field (akin to KiwiBank in New Zealand), Ahmed Fahour, the former NAB executive, and at one stage CEO-elect of Rudd Bank, was selected as the national postie’s new CEO. Since that time Fahour has hired a bunch of bankers, while the government last week appointed an experienced investment banker, Jenny Seabrook, to its Board.

I have previously argued that rather than establishing an expensive and possibly risky balance-sheet capacity, the quickest and most efficient way to monetise Aussie Post’s otherwise stagnant business while enhancing competition in the banking and finance markets would be to open up its 3,300 outlets as a new distribution channel for non-major lenders.

In this way, Aussie Post could better commercialise a vast and otherwise untapped origination infrastructure while helping regional banks, building societies and non-bank lenders overcome one of the chief hurdles they confront when trying to compete against their bigger brothers: the absence of a national branch network.

Curiously, Aussie Post last week announced a distribution deal with Fahour’s alma mater to distribute NAB’s business banking products via its outlets. Harnessing the national mail utility to further entrench larger lenders’ competitive advantages was not what I had in mind. But I am sure there are sound reasons underlying this deal.

Perhaps more encouragingly, the current speculation swirling around Aussie Post insinuates that it will focus on offering access to finance to SMEs in addition to vanilla home loans. This is good news for two reasons. First, if Aussie Post can prudently extend the pool of credit available to SMEs, which have had the finance available to them rationed since the GFC (in terms of both its cost and supply), then it will have assisted mitigate a national economic vulnerability. If Aussie Post concurrently helps smaller, second-tier lenders expand their business banking capabilities, which are currently weak, then they will have also advanced national competition policy objectives.

In recent weeks we have also read much about the funding problems faced by the major banks, which, it is argued, might impair their ability to supply credit to local businesses and households. At the same time, we have had a recycling of previously-aired concerns about the relative portfolio weights the major banks have to ‘residential’ as opposed to ‘business credit’. I will deal with these issues in turn.

If one steps back from the fray, and takes an open-minded and longer-term view of the world, it would seem that a possible solution to the major bank’s funding woes lies in their laps. Let’s take as given that the big banks’ main goal is to maximize the availability of funding for the purposes of fulfilling their primary, taxpayer-supported function: transforming domestic savings into credit to in turn underwrite domestic investment. With this objective in sight, a number of large, but as yet untapped, capital raising opportunities are open to them.

The first idea would be to streamline their business models by concentrating on simple savings and loan activities. Embracing this logic, CBA could raise billions of dollars of valuable equity capital by offloading its Colonial First State funds management business as an independent concern. A back of the envelope valuation might be more than $3 billion on the basis of its $100 billion plus in sticky retail assets under management.

Here one has to ask what comparative advantage commercial bankers have in producing ‘investment’ services. Distribution is a core competency, to be sure. But punting equities and so forth? Perhaps not.

By hiving off their asset management businesses, the major banks might also improve the competition that currently exists amongst the investors that service our rapidly consolidating $1.3 trillion superannuation sector.

Along these lines, NAB could presumably raise billions by selling MLC. The same principle could also apply to Westpac with Hasting Funds Management and BT. And with respect to ANZ and ING.

Another compelling fund-raising opportunity for the major banks is found in their non-core, offshore businesses. A key learning from the GFC was that these overseas exposures have the potential to cruel domestic banking operations when disaster strikes (think of what happened to the UK ‘high street’ banks).

We recently learned that NAB had been forced by UK regulators to inject $665 million of capital into it UK subsidiary, Clydesdale. Had his money stayed in Australia it could have potentially supported 10 to 20 times that sum in lending to local corporates, SMEs and households.

ANZ is currently spending billions buying banking businesses throughout Asia. Setting aside the risk that ANZ might also be called on by a foreign regulator to bail-out its Asian subsidiaries, which, in many cases, are subject to greater economic, political, and rule of law risks than in the UK or US, the equity ANZ is diverting overseas could also support 10 to 20 times its amount in credit to domestic borrowers.

For some, these might be radical proposals. But by raising vast amounts of new equity, and concentrating on their local savings and loan functions, the major banks could significantly increase their Tier 1 capital ratios, and commensurately lower the interest rates they pay on their own debt facilities.

These better funded, lower leverage, and more focused business models would no doubt attract praise from APRA and the RBA. In the post-GFC world, regulators are demonstrably anxious about the tensions between taxpayer subsidies of too-big-to-fail institutions and the moral hazards these induce into executive decision-making.

I will conclude today with some comments on the related business versus residential credit debate. Much media attention has recently galvanized around the argument that the major banks’ circa 60:40 bias in favour of residential, as opposed to business, lending, which reverses the ratio the majors had at the time of the last recession, gives rise to national policy problems by allocating excess funding to ‘unproductive’ housing. It is claimed that these weights are a function of a flawed prudential system, which makes business lending more expensive than residential credit.

Since there is scope for enormous confusion on this subject, it is important to deal with the essential elements of the argument piece-by-piece. As the RBA has repeatedly belaboured in response to business bankers’ claims, the first key point to acknowledge (aside from the bankers’ obvious conflicts), is that there is a good reason why the prudential system applies higher risk-weights to business lending, which can be unsecured and of a short-term nature: it is riskier than offering 25 year home loans secured against millions of nationally-diversified homes.

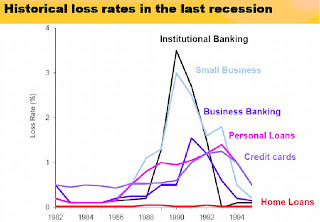

Here CBA has kindly obliged us by disclosing the loss rates it realised during the last recession on its small business, institutional banking, business banking and home loan portfolios. The residential mortgage exposure is depicted by the lowest red line in the chart below. If you compare this with the losses CBA suffered on loans to small business or larger corporates, you can see that notwithstanding this period saw a huge increase in unemployment from 5.6 per cent in 1990 to 10.9 per cent in 1992, the losses on business lending were literally orders of magnitude higher than those on CBA’s home loan portfolio.

Following this searing experience, which came close to triggering the collapse of Westpac and ANZ, the major banks wisely reduced their very high exposures to business lending, which some would have us now reverse. Assistant Governor of the RBA, Dr Guy Debelle, puts it this way:

“[I]n the early 1990s, a number of factors contributed to the banking system shifting its focus from lending to business towards housing…First, the banks suffered large losses on their business loan portfolios during the early 1990s recession. In contrast, the losses on their housing loans were relatively mild, notwithstanding the fact that the unemployment rate rose to about 11 per cent and mortgage rates reached as high as 17 per cent… As a result of these factors, between 1991 and 1995 the share of business loans in banks’ total lending fell by 15 percentage points to 48 per cent, while the share of housing lending rose by 16 percentage points to 46 per cent. Since then, this trend has continued…”

Unsurprisingly, a very similar pattern reasserted itself during the recent downturn. The next chart below shows the impact of the GFC on CBA’s residential and business lending products. Compare the red bars that apply to the home loan and business credit portfolios, which are a function of CBA’s expected losses. The picture is clear.

If you don’t believe CBA’s analysis, you can perhaps rely on the Governor of the RBA’s response to this debate:

“I think it is an economic fact that lending for mortgages has historically been far safer than for other things. That is why the Basel process downweighs the weighting on mortgages when you are calculating the capital charges…It is true that the capital charge system does discriminate, but that is what it is supposed to do because mortgage lending is less risky and that is why a business loan costs more to get.”

As I have demonstrated before (see here), the argument that lending to housing is ‘unproductive’ is equally spurious and inconsistent with economy theory. Both new and established housing, which supplies the shelter for Australia’s 10.9 million person labour force, is just as productive as any other investment, like the agricultural assets that produce the food for us to eat, or the commercial property investments that accommodate businesses.

A final thought for alleviating the funding stresses facing Australia’s banking system, and competition considerations more generally, lies in our superannuation sector.

Prior to the establishment of super in 1992, workers’ savings were deposited with banks, which in turn recycled them as relatively safe credit to business and households. The creation of the super system has caused an enormous shift in these savings away from lower-risk debt capital markets into vastly higher-risk equities. Today the typical Australian super fund has a 50-60 per cent weight to the 15 to 20 per cent annum volatility spawned by the Australian and overseas share markets. Unfortunately, our $400 billion self-managed super sector has even higher exposures to equities again. The main casualty of this approach is fixed income investments, which account for less than 15 per cent of all super money. Here we are talking about highly-rated bank bills, corporate bonds, government debt, CMBS and RMBS, to name just a few. That is, the credit that funds the entire financial system.

We’ve presented analysis (see here) that suggests that irrespective of the horizon over which one runs portfolio optimisations, Australian super funds should be halving their weights to shares in line with the Future Fund’s target exposure of around 25 to 30 per cent. And the key substitute is dramatically higher capital allocations to investment-grade fixed income assets. This finding is even more germane in the context of a society that has an ageing population, which is, by definition, increasingly risk-averse and therefore seeking certainty of investment payoffs as opposed to speculative growth.

If super fund trustees followed this advice, they could inject enormous volumes of new liquidity into the corporate bond, bank bill, CMBS and RMBS markets. By doing so, they would significantly reduce the financial system’s reliance on offshore money for funding while also expanding the pool of capital available to smaller lenders.

Many of the answers to the funding and competition concerns that consume so much of our attention can, therefore, be found in the circa $780 billion worth of workers’ savings that is squirreled away in shares.